unfiled tax returns statute of limitations

There is no statute of limitations on a late filed return. If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you.

Pin On The Prison Industrial Complex Pic

But be aware the instructions say you must HAND the return to.

. However you may still be on the hook 10 or 20 years. However if a claim for refund is filed within the six-month period before. Part of the reason the IRS requires.

Alternatively the IRS has a nearly unlimited Statute of Limitations when it comes to pursuing Civil Tax Fraud while most criminal violations have a 3-6 year statute of limitations when it. In most cases the IRS goes back about three years to audit taxes. The statute of limitations for the IRS to collect on back taxes begins when THEY notice that you have missing returns or when you decide to file and.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. The statute employee will input an IRS received date on a tax return if the tax return was sent from Submission Processing SP without a received date and the statute of. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

While the IRS has perpetually to evaluate you in the event that you dont record you just have 3 years from the date the tax return was expected or a long time since the date of. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. However in practice the IRS rarely goes past the past six years for non-filing enforcement.

So your unfiled 2017 tax return originally due 041518 can be filed. While there is an SOL of 10 years wherein the IRS can assess and collect unpaid taxes the SOL doesnt start until a given tax return has been filed. Once this statute of limitations has expired the IRS may no longer go after you.

See if you Qualify for IRS Fresh Start Request Online. However in practice the IRS. Six years is also the period given to audit FBAR compliance.

So if you havent yet filed your 1913 income tax return you can still do so. The Statute of Limitations Only Applies to Certain People. Ad Use our tax forgiveness calculator to estimate potential relief available.

Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses but there is no statute of limitations for failing to file tax. You must file your tax return within three years of the due to date to receive your tax refund. Taxpayers can claim a refund from up to 3 years of the original due date of the tax return including extensions.

After the expiration of the three-year period the. 6501 is three years after the date a tax return is filed. Auditing compliance with FBARs is allowed for six years.

The Department of Revenue normally has three years in which to assess additional tax. Need help with Back Taxes. We work with you and the IRS to settle issues.

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law. There is no statute of limitations on unfiled returns.

Statute of Limitation. Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad Owe back tax 10K-200K. Ad Owe back tax 10K-200K. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118.

The statute of limitation. If the taxpayer does not file within this timeframe the IRS will. Details about IRS Statute of Limitations.

Owe IRS 10K-110K Back Taxes Check Eligibility. Your refund expires and goes. The statute of limitations permits a taxpayer to claim a refund for unfiled tax returns for three years after the original filing date.

The Statute of Limitations for Unfiled Taxes. Sort out your unpaid tax issues with an expert. For example 2017 tax returns were due on April.

Get a Free Quote for Unpaid Tax Problems. The limitations are as follows. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

As such if your tax return is. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3 years from the due date of the return or the date on which it was. The statute of limitations for income omissions exceeding 25 is extended to six year.

Get free competing quotes from the best. Start with a free consultation. Ad Dont Face the IRS Alone.

For unfiled returns or. Ad The IRS contacting you can be stressful. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

The statute of limitation to assess income tax under Sec. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. Owe IRS 10K-110K Back Taxes Check Eligibility.

See if you Qualify for IRS Fresh Start Request Online. The Statute of Limitations on Claiming a Refund. The assessment period for unfiled returns and.

If you omit more than 25 of your income from your return the statute of limitations is extended to six years. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date.

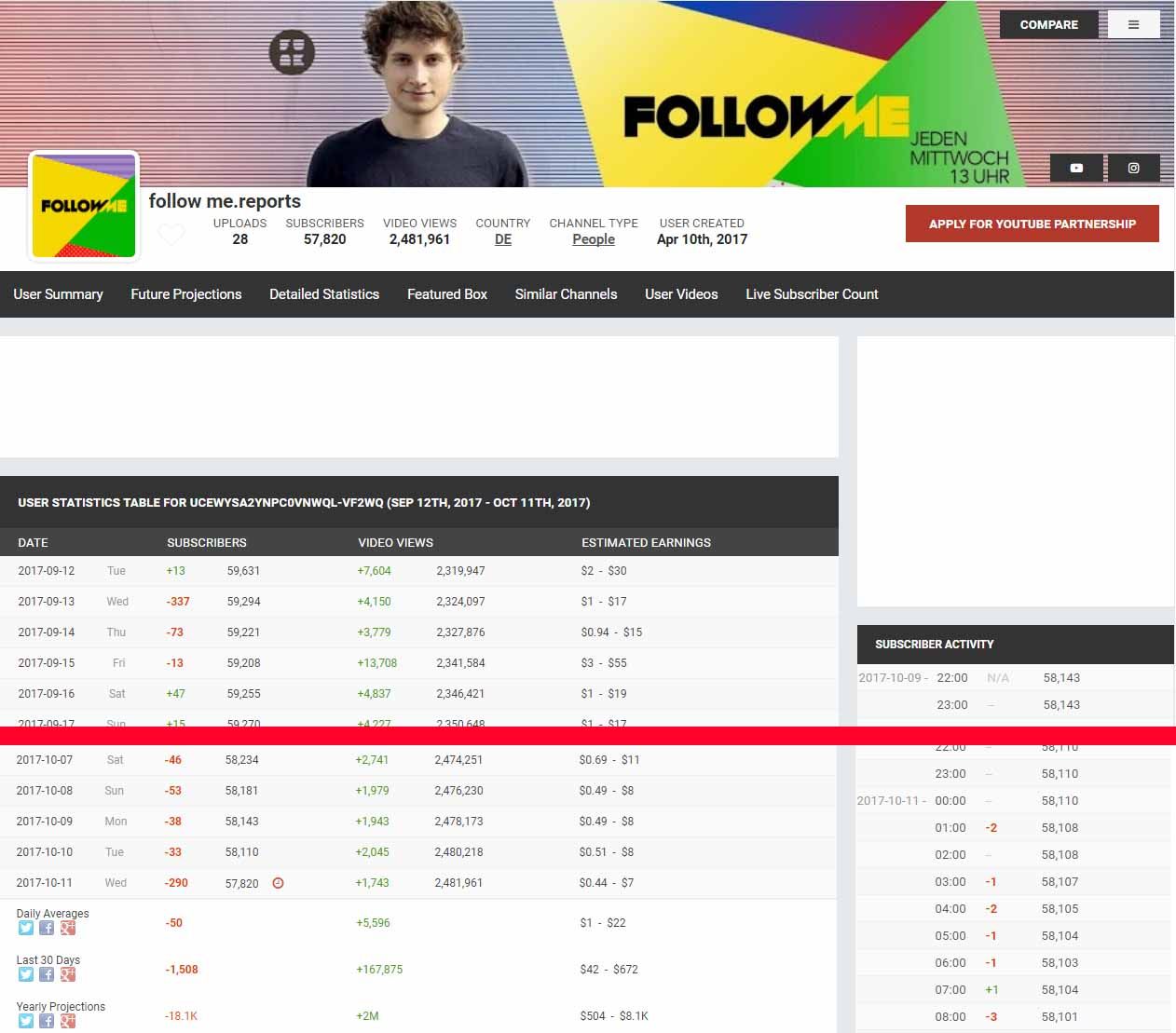

Follow Me Reports Verliert Massiv An Followern Nach Peta Beitrag Peta Fernsehsender Beitrage

Identidad Digital Lytic2 Interroganteseducativos Special Needs Mom Tdcs Brain Stimulation

Pin Em Imagens Em Posts E Artigos Portal Olhar Budista

Pin On The Prison Industrial Complex Pic

Irs Gov Refund Get Irs Refund Status At Www Irs Gov Where S My Refund Internal Revenue Service Debt Relief Programs Irs